Over the past two decades, the landscape of money management, including payments, transactions, storage, and exchange, has undergone significant transformation. We’ve witnessed a steady evolution from physical cash to bank deposits, then to convenient UPI wallets, culminating in the emergence of cryptocurrency – a revolutionary form of digital money that exists purely in the virtual realm.

In essence, cryptocurrencies are digital assets stored on devices like computers or laptops, facilitating secure online transactions. Much like foreign exchange, these digital currencies are actively used for investments, trading, and various payment methods. Let’s delve deeper into the fundamental nature of cryptocurrencies.

Understanding Cryptocurrency: What is Digital Currency?

Cryptocurrency is defined as a digital or virtual currency designed for secure online transactions. Its security is primarily guaranteed by cryptography, which effectively prevents counterfeiting and ensures the integrity of online purchasing agreements.

In common terms, cryptocurrency serves as a medium of exchange for goods and services transacted online, powered fundamentally by robust blockchain technology. This virtual money has no physical form and operates on a decentralized network, meaning it is not controlled by a central authority such as banks or governments. Transactions occur directly between two parties, eliminating the need for intermediaries.

Bitcoin gained prominence as the first decentralized cryptocurrency, introduced as open-source in 2009. Today, the crypto market boasts over 6,000 “altcoins” – alternative cryptocurrencies such as Ethereum, Tether, XRP, and Chainlink, among many others. Each digital currency maintains its unique market capitalization, and these currencies are frequently referred to as ‘tokens’.

How Does Cryptocurrency Work? Exploring Decentralization and Blockchain

Typically, an online transaction between a consumer and a retailer involves a central authority—like a bank, government, or other financial institution—acting as an intermediary, commonly known as a ‘third-party’. Digital currencies, however, bypass these intermediaries, ensuring a secure, direct, one-to-one transaction model, which is the essence of their ‘decentralized’ nature.

These decentralized exchanges are underpinned by a distributed ledger that utilizes blockchain technology. This means every transaction, conceptualized as a ‘block’ or ‘node’ containing specific data, is added to a continuous chain only after being shared and validated by the entire network of individual computers, each maintaining an updated copy of the ledger.

For every new block to be confirmed, it must undergo verification by each node within the network. Additionally, each block is assigned a unique cryptographic hash for identification. This distributed ledger system inherent to blockchain technology ensures that a third party cannot easily trace transaction history, effectively rendering fraudulent activities impractical.

Read more: about Blockchain, here!

Consequently, cryptocurrencies function as a secure and private virtual payment alternative. Ultimately, your transactions remain confidential, with no central entity monitoring your financial activities.

Acquiring Cryptocurrencies: Platforms and Digital Wallets

Just as with traditional online shopping, dedicated platforms exist for purchasing cryptocurrencies. These ‘exchange markets’ enable you to acquire digital currencies in exchange for your fiat (real) currency. To hold and manage your cryptocurrency, a digital ‘wallet’ is essential, serving as the secure storage for your virtual assets.

A cryptocurrency wallet securely stores both public and private keys. A public key acts as your virtual address, which can be shared broadly for receiving funds. Conversely, a private key is a highly confidential credential, analogous to a bank ATM PIN, crucial for authorizing and initiating transactions.

The creation of these cryptographic keys relies on complex mathematical problems solved by sophisticated algorithms. This leads to a crucial question: how are these digital currencies generated in the first place? Let’s explore further.

The Origin of Cryptocurrencies: How Digital Coins Are Created

Fundamentally, cryptocurrency is created through code. In numerous instances, new digital coins are introduced into circulation through a process called mining.

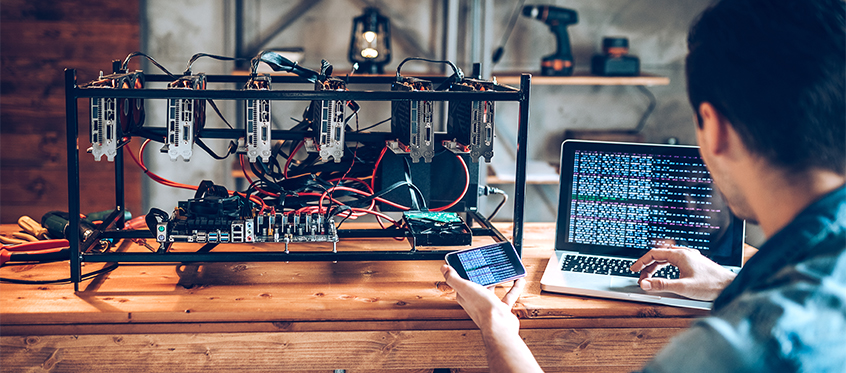

Within cryptocurrency networks, “mining” refers to the process of creating new virtual currency as a reward for validating transactions. This reward also serves as a complimentary incentive, often reducing transaction fees for the miner. When these currencies first emerged around 2009, generating hashes to validate transactions was relatively achievable using specialized hardware like Field-Programmable Gate Arrays (FPGAs) and Application-Specific Integrated Circuits (ASICs) that executed complex hashing algorithms.

As time progressed and the number of Bitcoin owners grew significantly, the demands of cryptocurrency mining evolved, leading to the adoption of more powerful Graphics Processing Units (GPUs) for solving intricate algorithmic puzzles to discover new blocks. Essentially, miners solve complex algorithms, earn digital currency, and can then exchange it for fiat currencies like dollars.

It’s important to note that while prominent cryptocurrencies like Bitcoin and Ethereum rely on mining for the creation of new coins, this isn’t universally true. Many other cryptocurrencies utilize alternative methods for coin generation, differing based on their inherent code and design.

The precise mechanism for coin creation is dictated by the specific code of each cryptocurrency. For instance, some cryptocurrencies may pre-mine a certain number of tokens at their launch to serve as developer rewards, while others might distribute tokens as regular dividends on a monthly cycle.

Anyone has the potential to engage in cryptocurrency mining. To learn more about how you can earn from cryptocurrencies, watch the video below:

Key Advantages of Cryptocurrency

- As decentralized virtual money, cryptocurrency transactions are inherently secure and do not involve third parties, ensuring heightened confidentiality for your dealings.

- Cryptocurrency transactions are typically swift and efficient, often incurring minimal processing fees, which helps users avoid the higher convenience fees commonly charged by traditional banks and financial institutions.

Potential Disadvantages and Risks of Cryptocurrency

While cryptocurrencies, operating on blockchain technology and being decentralized, inherently offer secure transactions by eliminating third-party intermediaries, they are not without risks. Cryptocurrencies can be stolen if hackers gain unauthorized access to a crypto-holder’s private key or associated codes. The risk of theft increases, especially if a token has weak security protocols or if the user’s digital wallet is frequently connected to the internet.

Historically, cryptocurrency has been controversially associated with illicit activities, including its use as a medium of exchange in online black markets, notably platforms like Silk Road.

Since cryptocurrencies are essentially code deployments stored digitally, a user’s digital currency balance can be permanently lost or wiped out if the storage device (like a hard drive) is lost or destroyed, particularly if a secure backup copy of the private key is not maintained.

Considering Investment in Cryptocurrencies?

While digital currencies offer compelling benefits such as enhanced security and rapid transactions, they frequently face criticism for their inherent volatility and lack of predictable stability, making them a unique investment class.

Notably, legendary investor Warren Buffett once drew a comparison between Bitcoin and traditional paper checks:

“It’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money too. Are checks worth a whole lot of money? Just because they can transmit money?”

While cryptocurrencies such as Bitcoin experience significant price fluctuations, their nature as digital assets with no inherent cash flow means their value is largely driven by speculation. Investors aim to sell them at a higher price than their purchase price. For instance, Bitcoin’s price soared to nearly $20,000 in December 2017, only to plummet to approximately $3,200 a year later. By September 2020, it had recovered to over $11,000. This volatility highlights the lack of traditional underlying assets or revenue streams that typically back conventional investments.

Related Posts

This inherent price volatility presents a significant dilemma: if investors anticipate Bitcoin’s value to appreciate substantially in the future, they become less inclined to spend or circulate it as a currency today, which ironically undermines its viability as a practical medium of exchange.

This indeed appears to be a dilemma. However, for many investors, cryptocurrency primarily represents a speculative asset.

References:

- https://cryptocurrencyfacts.com/how-is-cryptocurrency-created/#:~:text=Cryptocurrency%20is%20created%20by%20code,some%20other%20ways%20as%20well.

- https://en.wikipedia.org/wiki/Cryptocurrency

- https://www.investopedia.com/terms/c/cryptocurrency.asp

- https://www.nerdwallet.com/blog/investing/cryptocurrency-7-things-to-know/

Join our community by subscribing to our Weekly Newsletter to stay updated on the latest AI updates and technologies, including the tips and how-to guides. Also, follow us on Instagram (@inner_detail) for more updates in your feed.

For more such interesting informational, technology and innovation stuffs, keep reading The Inner Detail.