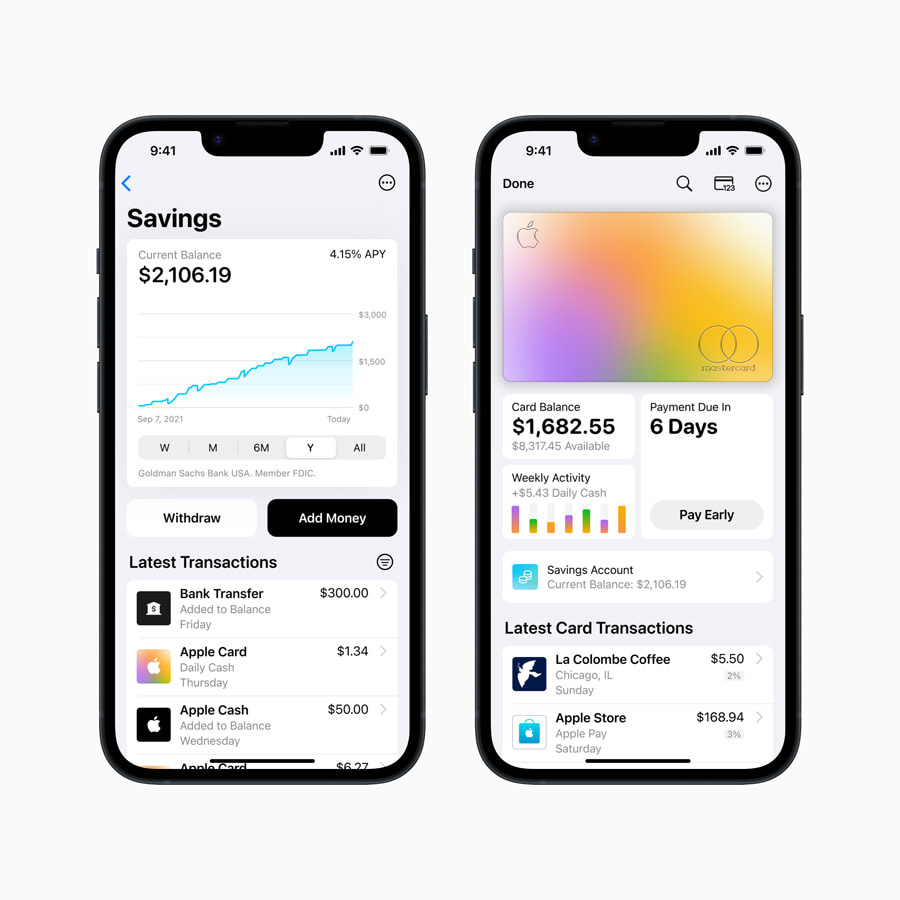

Apple brings the features and provisions of Bank account into its Apple Card by introducing Savings Account partnering with Goldman Sachs, providing 4.15% interest rate.

Apple initiated Apple Card business in 2019, which is a credit card created by Apple Inc primarily to be used with Apple Pay on apple devices for mobile payments to persons, in-app purchases, and also for online shopping payments. The card is issued by Goldman Sachs and is available only in US, with 6.7 million American cardholders as of early 2022.

In the course, Apple now introduces savings account in Goldman Sachs offering 4.15% interest rate, that’s 10 times more than the national average. Know the benefits, leverages and everything that is needed about Apple savings account.

Apple Savings Account

Apple Card users can leverage this Savings account for growing their Daily Cash rewards and deposit the daily rewards into their savings account. Further, they can manage their online purchases, transactions from their Savings account directly from Apple Card in Wallet.

Savings accounts of Apple are technically managed by Goldman Sachs, which means that balances are covered by the Federal Deposit Insurance Corporation. With the Wallet app, users can access their savings account, see the current balance, interest rate and most recent transactions. It also allows for depositing and withdrawal of money from and to a regular bank account or to Apple Cash Card at any time with no fees.

“Savings helps our users get even more value out of their favorite Apple Card Benefit – Daily Cash – providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s Vice President of Apple Pay & Wallet.

With the Savings account, Apple aims for providing convenience in handling finances, online transactions and in-app purchases, to spend, send and save Daily Cash – all from one place.

Benefits of Apple Savings Account

- Apple Savings account’s rate of interest is 4.15% APY, a decent rate when compared to that of competitive bank’s savings account. For comparison, you can see most of the banks provide interest rate ranging between 3% and 4.75% in US. However, the APY is not fixed and may subject to change at any time, Apple cited.

- Apple charges no fees for any transaction in and out of the Savings account.

- No minimum deposits for the Apple Savings account and there are no minimum balance requirements for the account.

- When customers pay with their Apple Card, they get cash back on all purchases. By default, all purchases grant you 1% in cash rewards and 2% for all purchases made using Apple Pay. Purchases with select merchants unlock 3% in rewards. Deposits of these rewards can easily be made into the savings account.

- The balances in Apple Savings account are insured by Federal Deposit Insurance Corporation (FDIC), Apple reported.

Cons

- There is a maximum balance limit of $250,000. Users can’t deposit more than $250,000 and they may have to withdraw the amount to a regular bank account.

- The 4.15% APY is not fixed and is subject to change at any time. Users hence aren’t assured of the same.

- The savings account is only available to people in US.

- Savings account by Apple is only for personal or family uses and it cannot be opened or maintained for business or trust purposes.

Related Posts

Pre-requisites for Apple Saving account

- You should be the owner or co-owner of an active Apple Card account.

- You are at least 18 years old.

- You should have an Apple Card added to your iPhone or iOS device.

- Social security number or an individual taxpayer ID number is required.

- You must be a U.S. citizen, resident with a physical U.S. address.

- Two-factor authentication for your Apple ID with the latest version of iOS is needed.

- To open an Apple Savings account, your iOS device should be updated with iOS 16.4 or later.

How to sign-up for Apple Card Saving Account?

- Open the Wallet app on your iPhone or iOS device and tap on “Apple Card”.

- Tap the More button and head to “Daily Cash”.

- Tap “Set Up” next to “Savings”, and follow the onscreen instructions to open a saving account.

FAQs

Does Apple Savings account require minimum balance?

No. Apple savings account do not require a minimum balance.

Do Apple savings account have a maximum balance limit?

Yes. Users can deposit only up to $250,000 in Apple Savings account.

Is Apple Card’s savings account FDIC insured?

Yes. The balances are covered by FDIC.

Can I convert Apple Savings account balance to money?

Yes. Users can withdraw the amount in savings account to a regular bank account. You can transfer up to $10,000 per transaction and up to $20,000 in a week from Apple Cash to your bank account.

Is Apple card necessary for Apple Savings account?

Yes. To open an Savings account in Apple, one should be an owner or co-owner of an Apple Card.

Comment down, if you have any doubts or queries regarding Apple Savings account.

Hope, you find the page useful!

(For more such interesting informational, technology and innovation stuffs, keep reading The Inner Detail).