Payments, transactions, storage and exchange of money have improved at least threefold in just over the last two decades. People had been constant in upgrading from cash form of money to bank deposits then to UPI wallets and to the ultimate – Cryptocurrency, which is a form of digital-money that doesn’t even exist in real world.

Cryptocurrencies are stored in digital devices like computer or laptop to make secure online transactions, in short. Likely as forex, the digital-money are also accustomed to investments and trading and payments. Let’s dive-in deep into what these cryptos really about.

Cryptocurrency

Cryptocurrency is a digital or virtual currency, transacted online as a medium of exchange, secured by cryptography, making it impossible to counterfeit on online purchasing pact.

Crypto-currency colloquially means of that money, exchanged for goods and transactions occurring online and is enabled by blockchain technology. The virtual money doesn’t exist physically and is decentralized, citing that cryptocurrency doesn’t depend centralized authority (like banks, government) and transactions being performed involving no third parties like banks or any medium, but only the Two handling the exchange.

Bitcoin holds the fame of being first decentralized cryptocurrency, open-sourced in 2009. At present there are over 6,000 altcoins (altcoins – other types of cryptocurrencies like Ethereum, Tether, XRP, Chainlink and so forth). Every digital money has its own market cap. The currencies are often considered as ‘tokens’.

Understanding Cryptocurrency

Generally, your online transaction between you and retailer requires a central authority, either bank or government or any firm acting as an intermediary for your exchange, hence called ‘third-parties’. Digital currency abstains these third-parties, confirming for a secured one-to-one transaction, leading to the term ‘decentralized’.

The exchanges are sustained by a distributive ledger applying the blockchain technology, heralding that every transaction (assume as a ‘block’ / ‘node’, consisting of transacting data) occurring in the planet gets conjoined as a chain after the same is shared and agreed upon by the entire network of individual node or computer maintaining a copy of the ledger.

Every new block created requires to be verified by each node before being confirmed and each block takes a hashtag for its unique identification. This distributive ledging of blockchain makes impossible to view back to the transaction history for a third person, betokening that any trickeries is useless.

Read more : about Blockchain, here!

Henceforth, cryptocurrencies are just a type of virtual payment options, held out safely and securely. Atlast, no one is viewing your transaction.

Purchasing Cryptocurrencies

Like you shop any things online, cryptocurrencies too have platforms for its purchases. Platforms of ‘exchange markets’, fetches you to own cryptocurrencies for an exchange of your real currency. Owning cryptocurrency compels for ‘a wallet’, wherein your digital money is stored.

A wallet stores public and private keys. A public key is a fundamental security ingredient, which may be disseminated widely, while a private key is a confidential input of transactions (just as pin numbers of ATM).

Cryptographic algorithms based on mathematical problems lets possible the creation of those keys. But how, these digital currencies as whole are created? Continue reading.

Where Cryptocurrency comes from?

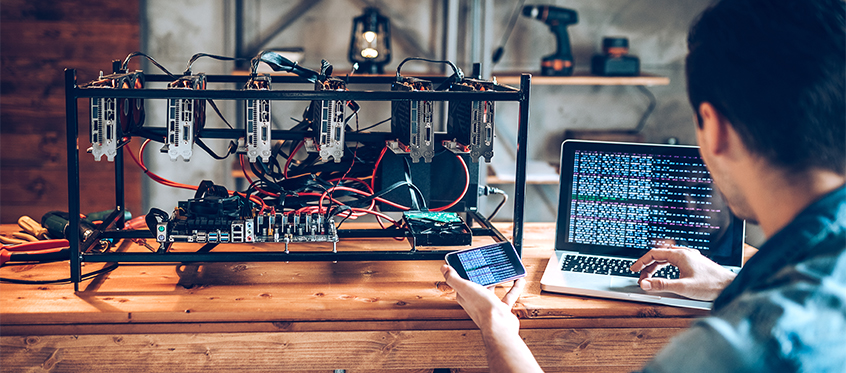

Cryptocurrency is created by code. In many cases, new coins are created when transactions are confirmed by a process known as mining.

Mining in cryptocurrency networks, means creation of new virtual money as a reward for every validation of transactions. The reward also lessens your transacting fee, as a complimentary incentive. At the onset of these currencies back at 2009, the rate of generating hashes for validating a transaction was quite feasible with specialized machines such as field programming gate array (FPGA) & Application specific integration circuit (ASIC), running complex hashing algorithms.

While as days gets passed, alongside the advent of million bitcoin owners, these mining bids upgraded graphic cards (GPU) for breakdowns of block findings. Miners solves an algorithm, owns digital money & exchange it for dollars. Simple.

With that said, while coins like Bitcoin and Ethereum use mining, not every cryptocurrency uses mining to generate new coins and coins can be created some other ways as well.

How exactly coins are created depends on what is defined by a given cryptocurrency’s code. For example, a cryptocurrency may create some tokens upon launch as developer rewards or a cryptocurrency may pay out tokens as dividends on a monthly basis.

Anyone can mine the cryptos & watch the video here to find how to earn from cryptocurrencies?

Advantages

- Virtual money, being decentralized is fully secure and doesn’t involve third parties, making your transaction confidential.

- Your dealings are quick and smooth and requires minimal processing fees, allowing users to avoid the convenience fees charged by banks and financial institutions.

Disadvantages

Cryptocurrencies runs on blockchain technology, and are decentralized eluding third-parties thereby making transactions secure. However, cryptocurrencies can be stolen if hackers gets access to a crypto-holder’s private-key or code. The vulnerability of cryptocurrencies being stolen is more when the token has poor security or even sometimes when it has access to internet.

Cryptocurrency had been a victim of use in controversial settings in the form of exchange in online black markets, such as Silk Road.

As cryptocurrencies are just code deployments, accrediting to software storage, implying that a digital cryptocurrency balance can be wiped out by the loss or destruction of a hard drive if a backup copy of the private key does not exist.

Investing in Cryptocurrencies?

Though, digital money felicitates secure, quick and the remaining perks, they are often criticized for not maintaining stability or strategy.

Of particular note, legendary investor Warren Buffett compared Bitcoin to paper checks:

“It’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money too. Are checks worth a whole lot of money? Just because they can transmit money?”

Cryptocurrencies like bitcoins may go up and down in value, but the thing is that being digital money having no cash flow, one must foresee to sell it in higher price than the buy price, implying merely of speculations. For example, bitcoin traded at close to $20,000 in December 2017, its value then dropped to as low as about $3,200 a year later. In September 2020, it was trading above $11,000. There’re no credentials behind, operating the money.

Related Posts

This price volatility creates a conundrum. If bitcoins might be worth a lot more in the future, people are less likely to spend and circulate them today, making them less viable as a currency.

A dilemma, it seems! But investors see crypto as speculations. Period.

References:

- https://cryptocurrencyfacts.com/how-is-cryptocurrency-created/#:~:text=Cryptocurrency%20is%20created%20by%20code,some%20other%20ways%20as%20well.

- https://en.wikipedia.org/wiki/Cryptocurrency

- https://www.investopedia.com/terms/c/cryptocurrency.asp

- https://www.nerdwallet.com/blog/investing/cryptocurrency-7-things-to-know/