Everything about – STOCK MARKET

What is the Stock Market? A Clear Definition

- The stock market, also known as the equity or share market, is a broad network where buyers and sellers engage in economic transactions involving stocks (shares). These shares represent ownership claims in businesses, making the stock market a collective of these transactions rather than a single physical location.

- It serves as a crucial platform where companies issue and sell their shares to investors to raise essential capital. Each share represents a minimal unit of ownership, and by selling a sufficient number of shares to various buyers, companies can secure the required funds.

- Stocks are typically classified by the country where the issuing company is based. While each company is listed on its domestic stock market, international buyers can actively participate in trading these shares.

“BUYING A STOCK OF A COMPANY IS BUYING A PART OF A BUSINESS”

– Warren Buffett

Essential Terms Used in the Stock Market

Before diving into the mechanics of the stock market, it’s beneficial to familiarize yourself with the foundational vocabulary frequently used in this dynamic environment. Here are some of the most commonly encountered terms:

- Dividends: A dividend is a portion of a company’s earnings distributed as a reward to its shareholders. Essentially, it’s the percentage of your stock’s value returned to you over a year, reflecting the company’s profitability.

- Primary & Secondary Market: When companies initially offer their shares to the public, the transactions between the company and the first buyers occur in the primary market. If these initial buyers later sell their purchased shares to subsequent investors, this trading takes place in the secondary market.

- Initial Public Offering (IPO): An IPO marks a company’s first release of shares to the general public to raise capital. For startups, an IPO is particularly vital as it plays a key role in funding their ongoing development and expansion.

- Bull & Bear Market: A market characterized by consistently rising stock prices is known as a bull market, indicating investor confidence and economic growth. Conversely, a bear market signifies a period where stock prices are consistently falling.

- Squaring Off: This process involves investors or traders either buying or selling shares and then reversing their original trade to complete a transaction, effectively closing their position.

- Beta: Beta is a statistical measure that quantifies the volatility or systematic risk of a particular stock or portfolio in comparison to the overall market. It indicates how much a stock’s price tends to move relative to the market.

- Market Capitalization: Often referred to as “market cap,” this represents the total value of a company’s outstanding shares, calculated by multiplying the total number of shares by the current share price. For a market to be considered significant for trading, its total capitalization often needs to be in trillions or hundreds of billions.

- Portfolio: A portfolio refers to the collection of financial investments held by an individual or an institution. This diverse holding can include various types of securities from different companies operating across multiple sectors, aiming to balance risk and return.

- Liquidation: This is the process of winding down a business and distributing its remaining assets to claimants. Liquidation typically occurs when a company is insolvent and unable to meet its financial obligations. As operations cease, assets are used to repay creditors and shareholders based on the priority of their claims.

- Common & Preferred Stocks: The primary difference between these two types of shares lies in voting rights and dividend preference. Common shares typically grant voting rights, allowing shareholders to influence corporate decisions such as the election of the board of directors or appointment of auditors. Preferred shares, however, generally do not carry voting rights but hold preference over common shares in receiving dividends and a greater claim to assets in the event of a liquidation.

“INVEST IN YOURSELF FIRST”

How the Stock Market Operates: A Comprehensive Guide

When a company is in its nascent stages or planning significant expansion, it often requires substantial capital. To secure these funds, the company typically issues shares to the public through an initial public offering (IPO). This strategic move transforms the company’s status from a private entity (where shares are held by a select few shareholders or partners) into a publicly traded company, with ownership distributed among a broader base of public investors.

As a company consistently demonstrates improved value and performance in the market, more prospective buyers become eager to invest and become shareholders. For instance, Apple’s remarkable market performance leads to an increase in its stock price, attracting numerous investors who buy its shares, thus boosting the number of buyers. Conversely, if a company faces challenges that diminish its market value, both the company itself and its existing shareholders may opt to sell shares at a reasonable price to mitigate potential losses. In such scenarios, the number of sellers will likely outnumber buyers.

Therefore, a fundamental principle of the stock market is that when buyers outnumber sellers, it signals positive company performance and rising stock prices. Conversely, if sellers exceed buyers, the company’s stock price tends to decline. For a market to be considered healthy and attractive, it should comprise companies that consistently achieve pronounced profits and, ideally, share a portion of these profits or dividends with their shareholders.

Furthermore, positive public perception, often influenced by favorable news, can significantly draw investors to a company. Investors are typically motivated to purchase shares only if they anticipate the company will perform better in the future, which in turn is expected to reflect positively on its stock performance.

“Make sure you choose the right news to focus on”

Consider the example of investor LeBron James, who in 2012 acquired a 10% stake in Blaze Pizza for less than $1 Million. By 2019, this investment had reportedly grown to $400 Million. This success story underscores that a deep understanding of the market and its operational dynamics can significantly help you develop into a skilled investor.

The Stock Market’s Impact on the Economy

When stock prices are on the rise, indicative of a bull market, investor confidence in market conditions generally increases. This uplift in investment values often leads to what is known as the wealth effect, where individuals feel wealthier and are more inclined to spend on significant purchases such as homes and cars. This increase in consumer spending, a major driver of Gross Domestic Product, directly contributes to economic growth.

In contrast, a bear market, characterized by falling stock prices, creates a negative wealth effect. This environment fosters uncertainty among consumers and a decrease in the value of their investment portfolios, subsequently leading to reduced spending on goods and services. Such a decline in consumer expenditure can adversely impact overall economic growth.

During periods of high stock prices, businesses are typically more inclined to make substantial capital investments due to favorable market valuations. This is also an opportune time for companies to launch Initial Public Offerings (IPOs), as the market sentiment is optimistic. Additionally, mergers and acquisitions tend to increase in a bull market as companies look to expand by acquiring others. All these activities collectively boost the economy. Conversely, in a bear market, public confidence in the market wanes, leading to reduced investments, declining stock prices, and a negative ripple effect on the economy.

“If a business does well, the stock eventually follows.”

Exploring Different Types of Stock Market Investments

The stock market offers a diverse range of investment opportunities beyond just traditional shares. For those seeking to mitigate risk and minimize exposure to market fluctuations, several other avenues exist to safely invest capital and generate returns. Investors can tailor their portfolios to align with their individual preferences and risk tolerance. Here are some of the major investment types available:

- Stocks / Shares

- Bonds

- Funds

- Mutual Funds

- Index Funds

- Exchange Traded Funds (ETFs)

1. Stocks and Shares: Understanding Equity Ownership

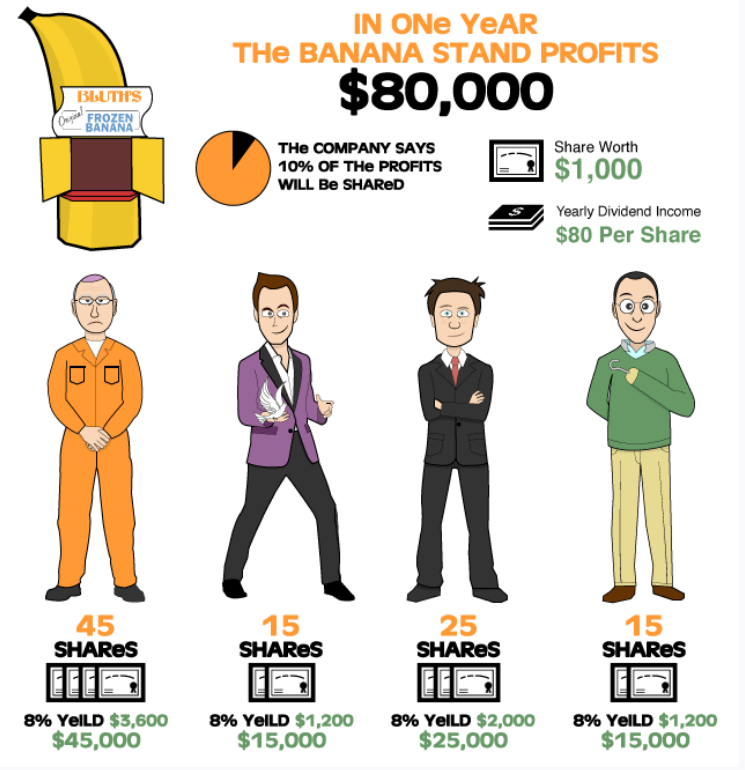

As previously mentioned, investing in stocks involves purchasing shares of a company, which signifies partial ownership. Typically, companies distribute a fixed percentage of their profits to their stockholders at regular intervals, known as dividends. While stock prices fluctuate frequently, increasing when the company performs well and decreasing when it faces challenges, it is generally advisable for investors to hold onto shares for several years. This long-term approach often maximizes potential profits, allowing investments to ride out short-term market volatility.

The image above visually demonstrates the potential profit distribution to shareholders based on example investments made by four individuals in a “Banana Stand” business.

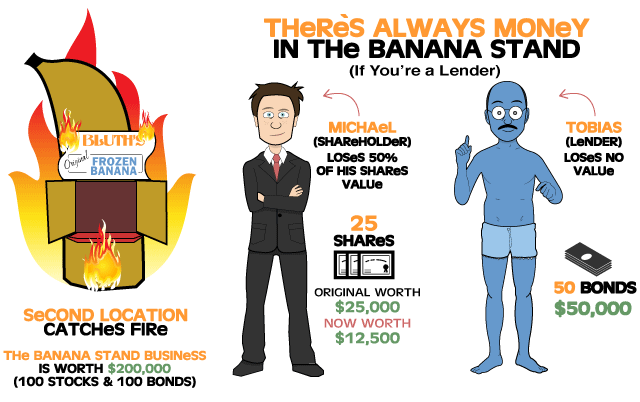

2. Bonds: A Look at Fixed-Income Investments

Bonds represent a form of loan made by an investor to a company or government entity. When you purchase a bond, the issuer agrees to pay you a fixed rate of interest over a predetermined period (typically annually), regardless of whether stock prices increase or decrease. Bond interest rates are primarily influenced by prevailing market interest rates and central bank policies, such as quantitative easing or interest rate hikes by the Federal Reserve. Consequently, bonds are heavily traded during periods of significant monetary policy shifts, making them a popular choice for investors seeking stable, predictable income streams.

This image illustrates Tobais’s bond investment with the “Banana Stand” and how this bond consistently generates a fixed rate of interest over the years.

3a. Mutual Funds: Professionally Managed Portfolios

Mutual funds enable individuals to invest through portfolio managers who professionally oversee their investments. These funds aggregate money from numerous investors and then allocate it across a diversified portfolio of stocks, bonds, or other assets. Portfolio managers diligently monitor and adjust the fund’s holdings, making investment decisions based on market conditions. While they make profits accessible to investors, they do take a percentage cut from the returns as a management fee. Mutual funds are particularly suitable for those who lack the time or interest to actively participate in the fluctuating market. However, it’s important to note that these funds typically involve higher costs, such as annual management fees and potential front-end charges, which can reduce an investor’s overall returns.

3b. Index Funds: Tracking Market Performance Passively

An index fund is a type of mutual fund designed to passively mirror the performance of a specific market index, rather than relying on an active manager to select individual investments. For instance, an S&P 500 index fund aims to replicate the performance of the S&P 500 by holding stocks of the companies included in that index. A key advantage of index funds is their lower cost, as they do not incur the expenses associated with an actively managed portfolio. The inherent risk of an index fund is directly tied to the volatility of the investments within the underlying index it tracks.

3c. Exchange-Traded Funds (ETFs): Flexible Index Investing

Exchange-Traded Funds (ETFs) are a popular type of index fund. Like traditional index funds, they track a specific market index (such as the S&P 500) and aim to replicate its buying and selling patterns. The primary distinction between index funds and ETFs lies in their pricing and trading flexibility. Index funds are typically priced once at the end of the trading day, meaning the purchase or sale price is fixed regardless of the transaction time. In contrast, ETF prices fluctuate throughout the day, allowing investors greater control over their entry and exit points and providing the ability to trade them much like individual stocks.

“Rich don’t work for Money! The Money work for them!”

Fundamental Investing Principles for Beginners

- To embark on a successful investment journey, it’s crucial to develop a thorough understanding of market behavior. This in-depth knowledge allows investors to identify and capitalize on profitable opportunities efficiently.

- Maintaining perseverance in holding shares, even amidst market fluctuations, can yield significant long-term benefits for investors. Resisting the urge to sell during downturns often leads to better outcomes.

- To safeguard your initial capital and mitigate risk, one of the most effective strategies, especially for beginners, is investment diversification. Instead of investing $1000 to buy 10 shares at $100 each, consider buying 100 shares of different companies at $10 per share. This way, if one share’s price drops, the potential rise in other shares can counterbalance the loss, helping to secure overall profits. However, it’s important to remember that while diversification is hugely beneficial for beginners, it isn’t always the sole optimal strategy for all investors.

- Regarding the use of brokers or brokerage firms, from an experienced investor’s perspective, it’s often preferable to manage shares directly to avoid considerable impacts from even a 1% share of profit going to a third party. However, if time constraints are an issue, brokerage firms can be a viable option. For those just starting in the investment field, having brokers assist you can be quite advantageous in navigating the initial complexities.

“Trust yourself to be a successful investor”

References:

- Stock Market – Wikipedia

- www.investopedia.com

- listenmoneymatters.com

- www.nerdwallet.com

- tradebrains.in